Episodes

![[REPLAY] S4, Episode 15-Dollars and Sense- A Book Review](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/brain_money.jpg)

Friday May 10, 2024

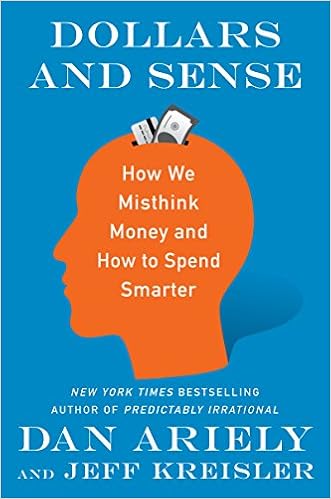

[REPLAY] S4, Episode 15-Dollars and Sense- A Book Review

Friday May 10, 2024

Friday May 10, 2024

When you think about money, your spending habits, and your instincts do you analyze the mental and emotional side to finance? Most people do not realize that there is a correlation between spending and human emotion.

Emotions play a powerful role in shaping our financial behavior, often making us our own worst enemies as we try to save, access value, and spend responsibly.

I have read the book: Dollars and Sense by Dan Ariely and Jeff Kreisler. I am going to give you a short synopsis of the book and my thoughts on the mental side of spending and saving your money.

In this podcast you will:

- Learn the mental side of finance aka behavioral finance and how your spending habits may or may not change based on your mood.

- Discover if getting something for free is too good to be true (HINT: You may be surprised by the very common result of a free promotion).

- Acquire ways that people avoid pain when it comes to money and spending. A lot of these tips are very easy to put into your routine.

- Gain practical tools needed to understand and improve your financial choices, save and spend smarter.

For all the show notes, transcription, and more, check out the podcast website at http://doctorfreedompodcast.com/

Investment advice is only offered in jurisdictions where Centurion Financial Strategies, LLC (“Centurion”) is appropriately registered or exempt from registration. Our Form ADV Part 2 brochure can be obtained free of charge at https://adviserinfo.sec.gov by searching for our firm by name or its unique CRD number (316454). This podcast is not a solicitation to provide advisory services in any jurisdiction in which we are not appropriately registered or excluded from registration.

The information, statements, and opinions contained in this podcast have been obtained from or are based upon information obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of any such information. This podcast is intended for informational purposes only and should not be construed as personalized investment, tax, or legal advice. Opinions expressed by any guest are their own opinions and do not necessarily reflect the firm’s views. You should carefully consider your unique financial circumstances and needs prior to making any investment in securities or purchasing any insurance products. Past performance is not indicative of future results. Investing in securities involves the risk of loss.

Insurance products are backed by the financial strength and claims-paying ability of the issuing insurance company and may be subject to restrictions, limitations, and early withdrawal fees which vary by issuer. You should consider the charges, risks, expenses, and investment objectives of any insurance products before entering a contract.

No comments yet. Be the first to say something!