Episodes

![[REPLAY] S4 Episode 11-How the Tax Reform Impacts You-Part 5-Residents and Fellows](https://pbcdn1.podbean.com/imglogo/image-logo/1303678/2016-12-23_Smaller-_New_Podcast_Image_300x300.jpg)

Friday Apr 12, 2024

Friday Apr 12, 2024

Hello my friends, welcome back to another episode of Freedom Formula for Physician's Podcast, the podcast dedicated to helping doctors like you slash your debt, slash your taxes, and live a liberated lifestyle.

I am excited for the start of the year here, as we are well on our way into 2018. I would like to ask a favor-could you take 5 minutes or less to rate and review the podcast on iTunes? I'd like to give some listener love to a few people who have recently received the podcast:

Todd, KS (paraphrased)-I came across this podcast in early 2017, and it has been a wonderful addition to my morning routine and commute. Dave has great guests on and gets right to their personal stories. These stories include financial struggles and pearls of wisdom-an an enjoyable listen. Highly recommended!

Dr. Mike WM-An excellent podcast for physician's-young and old. As doctors, we get zero business education in medical school, and Dave gives practical advice to help us on our financial journeys. Highly recommended!

There have been some BIG changes with taxes, and I've had a huge focus on addressing these changes between 2017 and 2018! And as a friendly reminder, you can text LESSTAXES to 44222, and that will give you all kinds of information with the tables I've been going over and possibly help you to apply for your specific situation.

In this podcast you will:

- Learn how itemizing is a much more difficult barrier for residents and fellows to get over

- Discover the difference in tax savings between being single and being married

If you think you may be paying more taxes than the numbers I've crunched, I'd love to hear from you and look over those numbers with you to see if I might be off on your calculations or if you might be off on your calculations. Also remember, you can e-mail me at dave@doctorfreedompodcast.com.

Read the rest of this entry »

![[REPLAY] S4 Episode 10-Med School, Residency, Loans-”OH MY”!-Navigating the course of Medical School Debt with Travis Hornsby](https://pbcdn1.podbean.com/imglogo/image-logo/1303678/2016-12-23_Smaller-_New_Podcast_Image_300x300.jpg)

Friday Apr 05, 2024

Friday Apr 05, 2024

Hello, my friends, this is Dave Denniston, and welcome back to another episode of Freedom Formula for Physician's Podcast, the podcast dedicated to helping doctors like you slash your debt, slash your taxes, and live a liberated lifestyle. And today we're focusing on the debit side of that equation.

- Learn how to make a strategic plan when graduating from med school with significant debt

- Get an inside look at Public Service Loan Forgiveness (PSLF) and how and when to apply

- Discover how Travis and his wife Christine navigated through the FFEL (Federal Family Education Loan) program

- Why you shouldn't consolidate all your loans at END of your residency

- Learn about the Direct Loan Program

- Why refinancing may be the best option to repay your student loans during residency

Resources mentioned in this podcast:

Contact Travis directly at travis@studentloanplanner.com

If you have questions or want to share your story, I'd love to hear from you. Contact me at dave@doctorfreedompodcast.com or on my website

www.doctorfreedompodcast.com.

If you are confused about this tax stuff and you want the latest copy of the Tax Reduction Prescription and that calculator I was talking about in January, there's no better time to grab that than right now! Text LESSTAXES to 44222.

Remember, make sure to slash your debt, slash your taxes, and live a liberated lifestyle.

![[REPLAY] S4, Episode 9-How The New Tax Packages Effects You- Part 4- With Kids and High Earners](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/shutterstock_55421095smaller.jpg)

Friday Mar 29, 2024

Friday Mar 29, 2024

There have been some BIG changes lately with taxes and they are likely to impact you in a big way!

You may have heard of the tax reform package, called appropriately, The Tax Cut & Reform Bill.

However, it may not be a win for everyone. Listen to this podcast and discover why.

In this podcast you will:

- Learn how to qualify for the 2018 child tax credit under the new tax reform bill.

- Discover the difference in taxes for high earners, 600K or above with a mortgage and children.

- In 2018 high earners have maxed out the number of their total deductions.

- What will happen if you have no state income tax? What states would you benefit more from by paying no state income tax?

For all the show notes, transcription, and more, check out the podcast website at http://doctorfreedompodcast.com/

Read the rest of this entry »![[REPLAY] S4, Episode 8-[Physician Fireside Chat] Doctorpreneur, Survivor, Physician Edna Ma [ednama.com]](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/shutterstock_31625377smaller.jpg)

Friday Mar 22, 2024

Friday Mar 22, 2024

Our next guest is a board-certified anesthesiologist working both in academic/private hospitals in Los Angeles. She is an entrepreneur, an author and a mother of two, and a wife. Where does she find the time?

In an attempt to raise money for her start-up, she accepted the challenge and opportunity to compete as a castaway on the hit reality TV show Survivor. She was on the hit TV show during season 5 of Shark Tank.

Edna has written three children’s books that celebrate cultural and racial diversity.

Outside of the operating room, Edna attempts to balance work, life, and being a mother/wife. I bet she has some tips we all could use for work-life balance.

Please help me welcome Dr. Edna Ma!

In this podcast you will:

- Learn Edna's different views on debt from residency to now.

- Discover her influences on money and how her unique childhood affects how she handles money today.

- Acquire her view on what financial freedom is to her and her family.

- Learn how creatively juggled her anesthesiology career and her side hustle.

- Find out why she calls her Survivor experience "creative financing!"(HINT: You won't believe this story)

For all the show notes, transcription, and more, check out the podcast website at http://doctorfreedompodcast.com/

Read the rest of this entry »![[REPLAY] S4, Episode 7-Tax Reform Questions Answered with CPA Craig Cody [Craig Cody and Company]](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/shutterstock_262041746smaller.jpg)

Friday Mar 15, 2024

Friday Mar 15, 2024

We’ve been talking a ton this year about the tax reform package and I thought it was time to bring back our most popular guest of the last year.

He is a Certified Tax Coach, CPA, Business Owner, and Former New York City Police Officer with 17 years' experience on the force.

He was my guest on Season 3, Episode 9 The 3 Awesome Tax Deductions I Didn't Know.

I know we’re going to learn a ton today as we dive into the changes and how they impact us.

Please help me welcome back Craig Cody!

In this podcast you will:

- Learn the changes with the child tax credit and the standard deductions, how will they benefit you?

- Discover what the section 199 deduction is and what professions would qualify.

- Acquire the difference in W-2 income versus pass-through income.

- Gain knowledge on filing your taxes if you are an owner of multiple businesses; are separate tax returns the best way to save in taxes?

For all the show notes, transcription, and more, check out the podcast website at http://doctorfreedompodcast.com/

Read the rest of this entry »![[REPLAY] S4, Episode 6-The Secrets of Tax Lien Investing Revealed with Joanne Musa from The Tax Lien Lady](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/house_of_money.jpg)

Friday Mar 08, 2024

Friday Mar 08, 2024

The last year we’ve spent a lot of time talking about real estate. But maybe you just don’t have the interest. You may want to get a higher return on your money than you can in a money market account or bank CD, but you don’t want to risk your savings in speculative investments and you don’t have time for real estate investing.

You want to do something with your money but you don’t know what, so it’s just sitting in a non-performing bank account making next to nothing. Or maybe you have invested in speculation and lost some of your retirement funds. That's the bad news.

But what if there was a way you could invest your money for high returns without shelling out a huge percentage of interest earned for fees, and you could do it without undue risk and without tenants, toilets, termites, or negotiating deals? Here’s the good news! There is a way for you to invest your money safely for high returns... and our next guest will show us how.

In the last 10 years, she has been known online as The Tax Lien Lady, has helped thousands of investors around the world to buy profitable tax liens and tax deeds with her step-by-step system.

Best of all, her easy-to-implement training programs have now helped people from all walks of life take control of their financial situation and their retirement.

Fasten your seatbelt because you are about to learn how to use a strategy for investing that has been carefully guarded by wealthy investors for decades!

Please help me welcome Joanne Musa, the Tax Lien Lady. Welcome, Joanne!

In this podcast you will:

- Discover how Joanne got into investing in tax lien properties and why she dove into real estate investing.

- Learn the many differences in rules and procedures from state to state and county to county.

- Discover the difference between a tax lien purchase and a tax deed purchase.

- Collect the different ways that you can acquire tax lien properties and the different ways to increase your profits.

For all the show notes, transcription, and more, check out the podcast website at http://doctorfreedompodcast.com/

Read the rest of this entry »![[REPLAY] S4, Episode 5-My Financial Experiment-Q4 2017 Update](https://pbcdn1.podbean.com/imglogo/image-logo/1303678/2016-12-23_Smaller-_New_Podcast_Image_300x300.jpg)

Friday Mar 01, 2024

[REPLAY] S4, Episode 5-My Financial Experiment-Q4 2017 Update

Friday Mar 01, 2024

Friday Mar 01, 2024

Welcome back to the Freedom Formula Physician's Podcast. If you have been listening to me for the last year, or maybe you're brand new, what I'd like you to do is go back to the archives, and check out season 3, where I started going through this process of acquiring other assets, trying to create multiple income streams. So this is the Quarter 4 2017 update. I'm going to walk you through my highs, my lows, and talk through the specifics of these various ventures that I have.

In this podcast you will:

- Discover my end game for taking on these risks

- Hear what's working and what's not working

- Learn how to protect yourself but apply wisdom and good strategy in business acquisitions

- Be enlightened on how time is your most valuable asset

Resources mentioned in this podcast:

My Financial Experiments-Q2 2017 Update

My Financial Experiments-Q3 2017 Update

I hope through this podcast, you see that although there is a lot of work, there is also a huge amount of opportunity. So whether you're getting into something similar to what I'm doing-buying a business, starting a new business, or something completely different, I want to encourage you to think about what that "side hustle" may look like for you, especially if you are experiencing burn out. I hope this podcast inspires you and encourages you-YOU are the smartest and brightest that we have in this country.

Please feel free to reach out to me with any questions at dave@doctorfreedompodcast.com.

Read the rest of this entry »

![[REPLAY] S4 Episode 4-Working the Side Hustle Flow- Nick Loper](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/shn-logo-2017.jpg)

Friday Feb 23, 2024

[REPLAY] S4 Episode 4-Working the Side Hustle Flow- Nick Loper

Friday Feb 23, 2024

Friday Feb 23, 2024

My name is Dave Denniston. Welcome back my friends to the latest episode of The Freedom

Formula for Physicians Podcast.

My friend, as you know, I am captivated by the idea of side hustles. I have this podcast of

course. I’m an author. I acquired a digital business earlier this year and now my wife and I are

getting into the land flipping business.

You may think that’s crazy and that’s okay! I have someone here with me who is just as crazy

as I am and we are going to dig in and find out why. Our next guest is the Chief Side Hustler at

Side Hustle Nation.

He’s an entrepreneur involved in a variety of projects. Like any business, it has its ups and

downs, which can be stressful, but he learns something new every day.

He started Side Hustle Nation because he believes in the hustle. He would say... after all,

what’s riskier: starting a business, or relying on your job as your only source of income?

He used to work full-time for a giant corporation, but he built his biz over many nights and

weekends. He believes that you can do it too.

Please help me welcome Nick Loper from The Side Hustle Show.

In this podcast you will:

- Be motivated to not just settle for an average life

- Receive advice on how to focus your time and assets on what works best for you

- Ask yourself this question: What assets or skills do I have that could be leveraged in a unique or valuable way?

- Learn how a side hustle can be fun and not stressful

- Discover tools on how to live life more proactive and less reactive

Resources mentioned in this podcast:

If you are a physician or someone else servicing physicians and want to tell your story, grapple

with these tough issues, and getting on the soapbox for a few minutes, I’d love to share it too in the

next Freedom Formula for Physicians Podcast.

Make sure to contact me at dave@doctorfreedompodcast.com or on my website

www.doctorfreedompodcast.com.

If you got tremendous value from this podcast, I would like to ask you a favor. Could you take a

quick minute and do a review on Itunes? It really helps the show and would mean a lot to me.

Remember, make sure to slash your debt, slash your taxes, and live a liberated lifestyle.

![[REPLAY] S4, Episode 3- How The New Tax Packages Effects You- Part 3- Married Physicians with 200k Income](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/moeny.jpg)

Friday Feb 16, 2024

Friday Feb 16, 2024

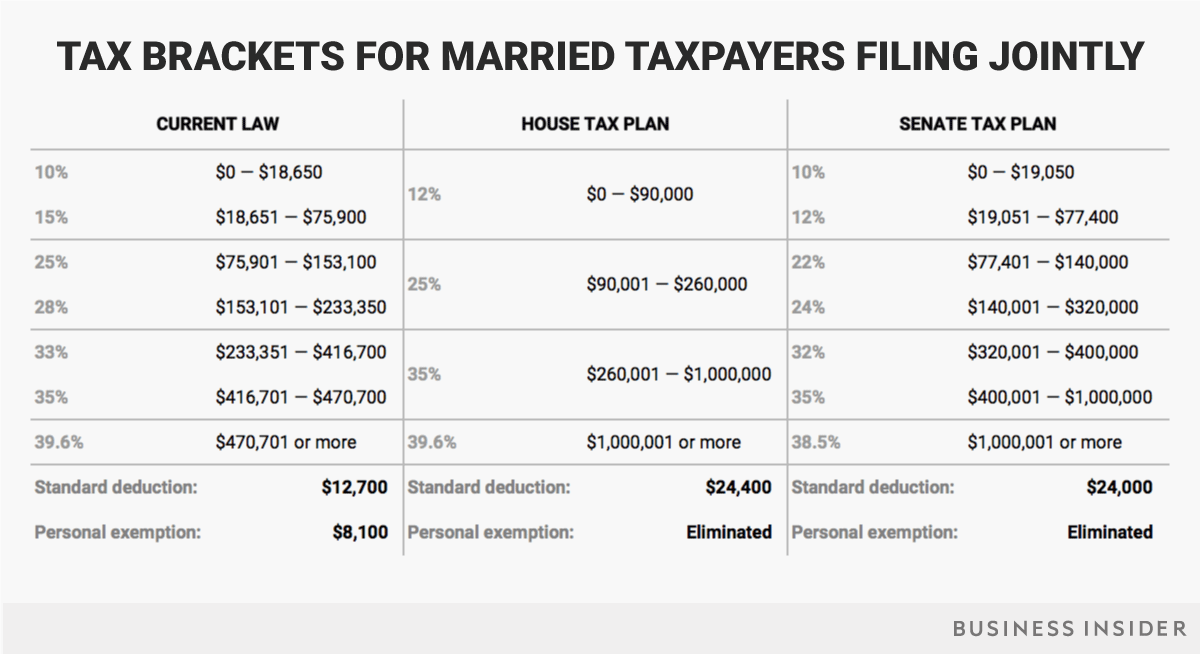

There's been some BIG changes lately with taxes and they are likely to impact you in a big way!

You may have heard of the tax reform package, called appropriately, The Tax Cut & Reform Bill.

However, it may not be a win for everyone. Listen in to this podcast and discover why.

There's a ton of numbers in this podcast! Check out the tables mentioned by clicking here.

In this podcast, you will find...

- LOTs of numbers and calculations that may leave your head spinning

- What has changed and what hasn't changed for a physician couple with 200k of income living in Minnesota

- The difference between someone who has a 200k mortgage versus a 500k mortgage

- How to re-think your mortgage debt depending upon your situation

- What has changed and what hasn't changed for a physician couple with 200k of income living in Washington state

- How tax brackets have shifted and why that may be creating winners and losers

Resources Mentioned or Should Have Been Mentioned In The Podcast That You Should Explore Further

How The New Tax Package Effects You- Part 1

How The New Tax Package Effects You- Part 2

3 Awesome Tax Deductions I Didn't Know with Craig Cody

Why Proactive Tax Planning Will Change Your Life with Diane Gardner

What The 2018 Tax Brackets & Standard Deduction May Look Like Under Tax Reform

What Your Itemized Deductions May Looks Like Under Tax Reform

Make These 5 Tax Moves Now Before the Law Kicks In

Here are the $5 Trillion of Winners and Losers

For all the show notes, and more, check out the podcast website at www.doctorfreedompodcast.com

Read the rest of this entry »

![[REPLAY] S4, Episode 2- How The New Tax Packages Effects You- Part 2- Married Physicians with 400k Income](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/smaller_Uncle_Sam_Wallet_Stealing.jpg)

Friday Feb 09, 2024

Friday Feb 09, 2024

There have been some BIG changes lately with taxes and they are likely to impact you in a big way!

You may have heard of the tax reform package, called appropriately, The Tax Cut & Reform Bill.

However, it may not be a win for everyone. Listen in to this podcast and discover why.

In this podcast, you will find...

- LOTs of numbers and calculations that may leave your head spinning

- What has changed and what hasn't changed for a physician couple with 400k of income living in Minnesota

- What has changed and what hasn't changed for a physician couple with 400k of income living in Washington state

- How tax brackets have shifted and why that may be creating winners and losers

Resources Mentioned or Should Have Been Mentioned In The Podcast That You Should Explore Further

How The New Tax Package Effects You- Part 1

3 Awesome Tax Deductions I Didn't Know with Craig Cody

Why Proactive Tax Planning Will Change Your Life with Diane Gardner

What The 2018 Tax Brackets & Standard Deduction May Look Like Under Tax Reform

What Your Itemized Deductions May Looks Like Under Tax Reform

Make These 5 Tax Moves Now Before the Law Kicks In

Here are the $5 Trillion of Winners and Losers

Read the rest of this entry »