Episodes

![[REPLAY] S4 Episode 21-My Financial Experiment- Q1 2018 Update](https://pbcdn1.podbean.com/imglogo/image-logo/1303678/2016-12-23_Smaller-_New_Podcast_Image_300x300.jpg)

Friday Jun 21, 2024

[REPLAY] S4 Episode 21-My Financial Experiment- Q1 2018 Update

Friday Jun 21, 2024

Friday Jun 21, 2024

Welcome back to the Freedom Formula For Physician's Podcast. If you have been listening to me for the last year, or maybe you're brand new, what I'd like you to do is go back to the archives, and check out season 3, where I started going through this process of acquiring other assets, trying to create multiple income streams. So this is the Quarter 1 2018 update. I'll be discussing my online business, this podcast, and my latest craze, land flipping while walking you through my highs, my lows, and the specifics of these various ventures.

In this podcast you will:

- Get an update on what's going on with my life

- Discover what's going on with my different financial experiments

- Hear about what's working and what's not working

- Know the lessons I'm learning along the way

I hope through this podcast, you see that although there is a lot of work, there is also a huge amount of opportunity. So whether you're getting into something similar to what I'm doing-buying a business, starting a new business, or something completely different, I want to encourage you to take a step of your comfort zone and try something new. If you don't take a risk, you'll never know what can happen. I hope this podcast inspires you and encourages you. If you'd like more information, feel free to contact me at dave@doctorfreedompodcast.com

Text DOCBOOK to 44422 for exclusive offers on my latest book, The Young Physician's Guide to Money & Life with over $100 of bonuses. If you have questions or want to share your story, I'd love to hear from you. Contact me at the email address above or on my website www.doctorfreedompodcast.com.

Thank you for joining us for Freedom Formula for Physician's Podcast-a podcast dedicated to helping you slash your debt, slash your taxes, and live a liberated lifestyle.

Read the rest of this entry »

![[REPLAY] S4, Episode 20-It‘s time to say ”Enough is enough” to Student Debt with Nii Darko from Docs Outside The Box](https://pbcdn1.podbean.com/imglogo/image-logo/1303678/2016-12-23_Smaller-_New_Podcast_Image_300x300.jpg)

Friday Jun 14, 2024

Friday Jun 14, 2024

Welcome to another episode of Freedom Formula for Physician's Podcast. I'm excited to have a repeat guest, Nii Darko, from Doc's Outside The Box, on today's episode. He's sharing the excitement of paying off not only his student debt, but his wife's also. Combined they shared $662,000 of debt. He shares about how he and his wife early on were paying more into their cash value plans than into their student loans, and that the frustration of that lead them to say "enough is enough".

In this podcast you will:

- Discover why if you're married, working with your spouse as a team to combine and slay your "debt dragon" together is the best strategy

- Learn how surrendering their cash value life insurance helped Nii and his wife pay off a significant amount of their debt

- Uncover a great method to paying off your debts by categorizing

- Discover the sacrifices Nii and his wife made to pay down their debts

- Hear Nii's thoughts on how he feels the medical field is changing

Resources mentioned in this podcast:

Text DOCBOOK to 44422 for exclusive offers on my latest book, The Young Physician's Guide to Money & Life with over $100 of bonuses. If you have questions or want to share your story, I'd love to hear from you. Contact me at dave@doctorfreedompodcast.com or on my website www.doctorfreedompodcast.com.

Thank you for joining us for Freedom Formula for Physician's Podcast-a podcast dedicated to helping you slash your debt, slash your taxes, and live a liberated lifestyle.

Read the rest of this entry »

![[REPLAY] S4, Episode 19-Creating a Passive Income=FREEDOM with Scott Bossman from Land Bosses](https://pbcdn1.podbean.com/imglogo/image-logo/1303678/2016-12-23_Smaller-_New_Podcast_Image_300x300.jpg)

Friday Jun 07, 2024

Friday Jun 07, 2024

Welcome, my friends to another episode of Freedom Formula for Physician's Podcast. I have been sharing my own financial experiments with you, and it's been great having guests on the podcast that I've met through those financial adventures. Today my guest is Scott Bossman, another land-flipping colleague of mine, who shares his own experience in what most would call, a "boring" business. Throughout our episode today, you will hear Scott's journey of how he and his wife's decision to venture into land flipping not only helped to create financial freedom and independence for them and their four growing boys but also helped him to better appreciate his career as a physical therapist.

In this episode you will:

- Hear how Scott dealt with and overcame the anxieties of starting the land flipping adventure

- Learn why the relationship is key in every type of business

- Discover the success of raw land flipping

- Learn each step and the tools of the business

- Hear an update on my own land flipping business adventure

Resources mentioned in this podcast:

Keith Weihold-Get rich education podcast

Scott & Erin Bossman-Land Bosses

Text DOCBOOK to 44422 for exclusive offers on my latest book, The Young Physician's Guide to Money & Life with over $100 of bonuses. If you have questions or want to share your story, I'd love to hear from you. Contact me at dave@doctorfreedompodcast.com or on my website www.doctorfreedompodcast.com.

Thank you for joining us for Freedom Formula for Physician's Podcast-a podcast dedicated to helping you slash your debt, slash your taxes, and live a liberated lifestyle.

Read the rest of this entry »

![[REPLAY] S4, Episode 18: [Physician‘s Fireside Chat] with EJ from Dad‘s, Dollars, & Debts](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/shutterstock_250444009_smaller.jpg)

Friday May 31, 2024

Friday May 31, 2024

Our next guest is a cardiologist from Northern California… and you guessed it- he is also a…. blogger- another blogger I found courtesy of the extremely lengthy blog roll from PhysicianOnFire.

He’s someone who is really passionate about his family and is playing around with the idea of retiring early but doesn’t seem quite sure yet. So, we’re going to get into that.

He’s 5 years into being an attending physician and is well on his way to financial independence.

Anyhow, I can’t wait to hear about his journey and his advice for us!

Please help me welcome EJ from Dads, Dollars, and Debts. Welcome EJ!

In this podcast you will:

- Acquire his views on living a modernism lifestyle versus a minimalist lifestyle.

- Learn how his family influenced his habits with money: spending and saving. Did EJ take on his parent's spending habits?

- Discover how a house fire ended up benefiting EJ and his family financially.

- Hear how EJ and his wife view spending money and how they balance their differences. (HINT: You may be surprised how EJ handles their differences.)

For all the show notes, transcription, and more, check out the podcast website at http://doctorfreedompodcast.com/

Read the rest of this entry »![S4, Episode 17-Discovering the Challenges and Successes of Being Married to a Physician with Lara McElderry [Married to Doctors.com]](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/podcast1.jpg)

Friday May 24, 2024

Friday May 24, 2024

My friends, in this show, I try and dig deep to find interesting people. Our guest today is not a doctor, but she is married to one. She is married to a surgeon and she is on a mission to help other physicians. Help them to understand their path and what it is like to be married to a physician.

She and her husband got married before he started his medical path. For 16 years they have struggled, triumphed through the MCAT, through medical school, through residency and fellowships including a specialty change. They have 4 kids and she knows that being married to a physician is not an easy journey. I know she is going to bring to us some wisdom and talk to us through their journey.

Please help me welcome, Lara McElderry! Welcome, Lara!

In this podcast you will:

- Learn the lessons that Lara would share with the physicians on how they could support their spouse and nurture their marriage.

- Discover the curveball that they dealt with that could have ended her husband's medical career.

- Learn how they survived having 3 kids while her husband was in medical school and residency and Lara was a stay-at-home mom.

- Find out the 3 subjects she aims to focus on within her podcast: Married to Doctors.

- Take in the biggest financial mistake that they made that Lara would not want you to do or have to go through.

For all the show notes, transcription, and more, check out the podcast website at http://doctorfreedompodcast.com/

Read the rest of this entry »![[REPLAY] S4, Episode 16-[Physician Fireside Chat] Doctorpreneur, Survivor, Physician Edna Ma-Part 2[ednama.com]](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/girl_stairs.png)

Friday May 17, 2024

Friday May 17, 2024

Our next guest is a board-certified anesthesiologist working both in academic/private hospitals in Los Angeles. She is an entrepreneur, an author and a mother of two, and a wife. Where does she find the time?

In an attempt to raise money for her start-up, she accepted the challenge and opportunity to compete as a castaway on the hit reality TV show Survivor. She was on the hit TV show during season 5 of Shark Tank.

Edna has written three children’s books that celebrate cultural and racial diversity.

Outside of the operating room, Edna attempts to balance work, life, and being a mother/wife. I bet she has some tips we all could use for work-life balance.

Please help me welcome Dr. Edna Ma!

In this podcast you will:

- Discover how Edna balances her medical career, family, and entrepreneurship ventures.

- Explore the pros and cons that came from her experience on Shark Tank, Did she get a deal???

- Receive tips and tricks to help you get on Shark Tank, the process may be a lot different than you may think it would be.

- Learn what new side hustle she is involved in (HINT: It's something that I have focused some podcasts on and I'm diving into myself!)

For all the show notes, transcription, and more, check out the podcast website at http://doctorfreedompodcast.com/

Read the rest of this entry »![[REPLAY] S4, Episode 15-Dollars and Sense- A Book Review](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/brain_money.jpg)

Friday May 10, 2024

[REPLAY] S4, Episode 15-Dollars and Sense- A Book Review

Friday May 10, 2024

Friday May 10, 2024

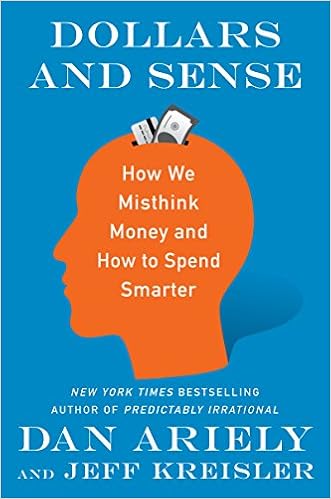

When you think about money, your spending habits, and your instincts do you analyze the mental and emotional side to finance? Most people do not realize that there is a correlation between spending and human emotion.

Emotions play a powerful role in shaping our financial behavior, often making us our own worst enemies as we try to save, access value, and spend responsibly.

I have read the book: Dollars and Sense by Dan Ariely and Jeff Kreisler. I am going to give you a short synopsis of the book and my thoughts on the mental side of spending and saving your money.

In this podcast you will:

- Learn the mental side of finance aka behavioral finance and how your spending habits may or may not change based on your mood.

- Discover if getting something for free is too good to be true (HINT: You may be surprised by the very common result of a free promotion).

- Acquire ways that people avoid pain when it comes to money and spending. A lot of these tips are very easy to put into your routine.

- Gain practical tools needed to understand and improve your financial choices, save and spend smarter.

For all the show notes, transcription, and more, check out the podcast website at http://doctorfreedompodcast.com/

Read the rest of this entry »![[REPLAY] S4 Episode 14-How the New Tax Reform Impacts You-Part 6-Small Business Owner, S Corps or Sole Proprietorship](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/tax-reform1-500x333.jpg)

Friday May 03, 2024

Friday May 03, 2024

Hello, my friends, this is Dave Denniston, and welcome back to another episode of Freedom Formula for Physician's Podcast. The podcast is dedicated to helping doctors like you slash your debt, slash your taxes and live a liberated lifestyle. As you know, there has been a lot of focus on tax reform. This will be my final one for the current future, and today's focus will be small businesses-S-CORPs, sole proprietorships, etc.

In this podcast you will:

- Discover how the new tax reform will impact small businesses

- Learn the difference between a corp and a sole proprietorship

- Discover how taxes differ between FICAs-Social Security and Medicare

- Get lots of questions answered from our episode with Craig Cody in February 2018

- Learn the difference between "above the line" and "below the line" tax deductions

- Uncover the still looming question, "Does the taxable income have to do with all of your income, or is it just based on your business income?"

Resources mentioned in this podcast:

How Pass-Through Income Will Be Taxed In 2018 For Small Business Owners

Tax Reform! How Physicians and the Self-Employed are Affected

Individual Tax Planning Under The Tax Cuts And Jobs Act Of 2017

A Tax Professional’s Take on Trump’s Tax Plan

If you are confused about this tax stuff and you want the latest copy of the Tax Reduction Prescription and that calculator I was talking about in January, there's no better time to grab that than right now! Text LESS TAXES to 44222.

If you have questions or want to share your story, I'd love to hear from you. Contact me at dave@doctorfreedompodcast.com or on my website

www.doctorfreedompodcast.com.

Remember, make sure to slash your debt, slash your taxes, and live a liberated lifestyle.

Read the rest of this entry »

![[REPLAY] S4 Episode 13-Home Buying and Interest Rate Update With Josh Mettle of Physician Financial Success](https://pbcdn1.podbean.com/imglogo/ep-logo/pbblog1303678/josh_mettle.jpg)

Friday Apr 26, 2024

Friday Apr 26, 2024

Hello, my friends, this is Dave Denniston, and welcome back to another episode of Freedom Formula for Physician's Podcast. Joining us for this episode is a three-time guest. He is an author, mortgage lender, specializing in physicians, dentists, CRNAs, and PAs, and you'll hear him on his own podcast, Physician Financial Success Podcast. Please help me welcome Josh Mettle.

In the past, we've discussed buying homes and rental real estate. This is a great time of the year to discuss these topics if you're transitioning to practice, buying your first home. Or maybe you've been an attending for the last year or two and now you're considering buying your first home. This episode is just for you.

In this podcast episode you will:

- Hear about the two colliding forces that will cause mortgage interest rates to go up from here on out, and how to prepare yourself for it

- Learn why mortgage rates are starting to move up, yields are moving higher, how that is affecting the season of buying bonds and how that will make an impact on home purchases

- Discover how new home sales, existing homes, and permits might be affecting demand and supply

- Get great advice on how to look at purchasing and owning your home with the "big picture in mind" vs. your home-owning you

- Learn why living like a resident financially after transitioning to practice for the first couple of years and paying off your student loans quickly will help you be better financially secure for the future

Resources mentioned in this episode:

Josh Mettle- Real Estate Smashing Failures & Glorious Successes

The Tax Reduction Prescription with Josh Mettle

Josh Mettle- The Pitfalls of Physician Mortgages

www.doctorfreedompodcast.com/homevalue

Physician Financial Success Podcast

If you have questions or want to share your story, I'd love to hear from you. Contact me at dave@doctorfreedompodcast.com or on my website

www.doctorfreedompodcast.com.

If you are confused about this tax stuff and you want the latest copy of the Tax Reduction Prescription and that calculator I was talking about in January, there's no better time to grab that than right now! Text LESSTAXES to 44222.

Remember, make sure to slash your debt, slash your taxes, and live a liberated lifestyle.

Read the rest of this entry »

![[REPLAY] S4 Episode 12-”Taking Wise and Necessary Risks”-Enjoying Life with David Stein from Money for the Rest of Us](https://pbcdn1.podbean.com/imglogo/image-logo/1303678/2016-12-23_Smaller-_New_Podcast_Image_300x300.jpg)

Friday Apr 19, 2024

Friday Apr 19, 2024

Welcome back my friends to the latest episode of Freedom Formula for Physicians' Podcast. I'm honored to have a guest on here with us today that has tons of experience in podcasting. With over 6 million downloads of his podcast and an accomplished career in the financial world, he is now enjoying life, traveling the world, and helping people with financial issues and questions. Please help me welcome David Stein of Money for Rest of Us.

In this podcast episode you will:

- Be motivated to not just settle with getting by

- Learn how to think "forward" as our economy is always changing

- Hear David's story of starting with nothing and moving to prosperity based on moving his thoughts to actions and taking necessary risks

- Discover David's formula for how his podcast is growing-it involves investing in his listeners and giving away resources for FREE

- Learn what some of the biggest financial pitfalls can be

- Be motivated to develop a lifestyle business after retiring, especially if you retire early

Resources mentioned in this episode:

Money For The Rest of Us Podcast

If you have questions or want to share your story, I'd love to hear from you. Contact me at dave@doctorfreedompodcast.com or on my website

www.doctorfreedompodcast.com.

If you are confused about this tax stuff and you want the latest copy of the Tax Reduction Prescription and that calculator I was talking about in January, there's no better time to grab that than right now! Text LESSTAXES to 44222.

Remember, make sure to slash your debt, slash your taxes, and live a liberated lifestyle.

Read the rest of this entry »